Economic Stress

Defining Economic Stress

Exacting many social and psychological costs on the quality of individuals and family life, economic stress affects a significant segment of the population.

Economic Stress has been defined to include substantial loss in work hours, income, or assets, the experience of material hardships such as food insecurity and inadequate housing or health care, or failure to make ends meet.

The economic crisis of 2007-2008 was arguably one of the most important global threats to individual wellbeing of the last couple of decades.

This crisis produced worldwide economic instability, leading to thousands of mass layoff events, increased long-term unemployment, and, among those fortunate to keep their jobs, greater uncertainty about their future employment prospects (Grusky, Western, & Wimer, 2011).

Voydanoff (1990) described economic distress as aspects of economic life that are potential stressors for individuals and families. She proposed four broad categories of economic stress measures based on distinctions between employment and income stressors and between objective and subjective stressors (Probst, 2004; Sinclair et al., 2010).

- Employment instability is an objective indicator of employment status, with examples of employment instability including unemployment status, unemployment duration, underemployment, and downward mobility.

- Employment uncertainty refers to subjective indicators of employment stability with the most common example being job insecurity (Probst, 2004).

- Economic duration refers to objective income-related stressors such as the inability to meet financial needs (e.g., because of insufficient income) and/or loss current income.

- Finally, subjective indicators of economic strain include perceptions of one’s financial status and perceived income adequacy.

Theoretical Explanation for Economic Stress Effects

There are numerous theories that provide explanations for why exposure to economic stressors leads to adverse effects. Given the tangible and intangible benefits associated with employment and income, it is perhaps not surprising that most relevant theories emphasize a resource-based approach to understanding economic stressors as significant determinants of stress Opens in new window and subjective wellbeing Opens in new window.

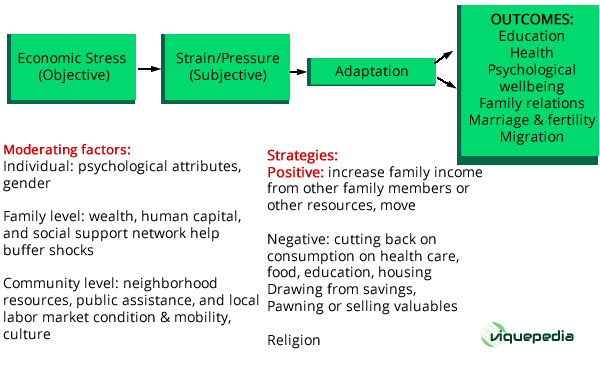

An overarching framework, depicted below, is used to summarize how authors in this collection conceptualize the nature and impact of economic stress. This framework integrates two theoretical traditions to examine the household response to economic setbacks:

- the family stress theory that makes sociopsychological factors into account and

- microeconomic theories that see family members pooling resources together and smoothing life course consumptions over time.

The Crisis Model originally developed by Hill (1949) forms the central concept of the family stress theory.

The model begins with certain stressor events such as job loss which precipitate changes in patterns of one or more of the following: family interaction, family goals, roles of family members, and values. Such changes potentially may destabilize the balance in the family necessary for effective family functioning.

The objective economic stress, measured by indicators such as major income or assets loss, often triggers a certain level of subjective economic strain/pressure among family members.

The degree to which a family adjusts depends upon the family’s social-psychological and financial resources to meet the changes and the family’s subjective perception of the stressor events.

Stress theory also considers the social context of the family and community resources. This basic framework was later extended by McCubbin et al. (1982) in a longitudinal study of family stress and crisis and elaborated upon by other researchers (George 1993; Zimmerman 1988).

Empirical research in the USA shows that economic problems may alter the socioemotional balance in the family which may result in marital discord and conflict and, perhaps, lead to divorce (Conger et al. 1990).

Conger and his colleagues further developed the family stress model to show the adverse effect of financial difficulties on parent’s emotions, behaviors, and relationship, which, in turn, affects their parenting behavior and children’s developmental outcomes (Conger and Conger, 2002, 2008).

In microeconomic theory, a family is viewed as an economic unit in which family members pool resources and make joint decisions about consumption to achieve their optimum wellbeing or utility.

Economic theory emphasizes the concept of permanent income (Blau & Ferber, 1992), which states that a family’s level of consumption is based upon the potential flow of income through time.

The concept of permanent income also states that a family’s level of consumption typically is indicated by the educational level of the head of the family or by the family’s income averaged over a number of years rather than by the family’s income at any point in time.

Thus, families save in good times and borrow in times of need. Families also manage by modifying the labor supply of family members. Wives and older children historically have been a source of additional income when needed by the family economy, which is added worker hypothesis (Sassier, 1995).

When a family experiences economic stress, family members tend to adapt to the change with various strategies, such as cutting back on consumption on health care, food, education, or housing, going on public assistance, drawing from savings, borrowing money, obtaining a loan, or selling assets (Yeung and Hofferth, 1998).

They may also seek alternative sources of income, move to a different location, send other family members to the labor market, or seek spiritual support. Throughout this process, family members’ life satisfaction and outlook to the future may change.

Figure X-1 depicts a set of moderators at individual, family, and community levels that may shape how economic stress affects a family.

Figure X-1 | Conceptual framework

Figure X-1 | Conceptual frameworkThese moderators include the psychological attributes of the individual and family members, stock of family wealth (savings and assets) and human capital, and social support networks that may buffer the economic stress, as well as community resources such as public assistance or local labor market conditions.

You Might Also Like:

- Research data for this work have been adapted from the manual:

- The Routledge Companion to Wellbeing at Work By Cary L. Cooper, Michael P. Leiter.

- Economic Stress, Human Capital, and Families in Asia: Research and Policy By Wei-Jun Jean Yeung, Mui Teng Yap.