Responsibility Centers

Types of Responsibility Centers and Associated Performance Measures

OrganizationsOpens in new window are typically composed of sub-units. For example, the firm might be organized into functional areas such as marketing, manufacturing, and distribution departments.

Other organizations are divided into sub-units by product or service offered. A university, for instance, is divided into colleges that conduct research and teach different disciplines.

Each of these subunits is commonly subdivided into smaller subunits. For example, manufacturing may be further subdivided into departments, and specialized groups within departments. Each of these subunits represents work groups and managers with specific responsibilities.

Responsibility accounting is the process of recognizing subunits within the organization, assigning responsibilities to managers of those subunits, and evaluating the performance of those managers.

These subunits of the organization, called responsibility centers, could be a single individual, a department, a functional area such as finance or marketing, or an entire operating division.

The managers of each of these responsibility centers have different responsibilities and, accordingly, different performance measures. In each case, responsibilities should be linked with the requisite specialized knowledge.

Responsibility accounting then dictates that the performance measurement system be designed to measure the performance that results from the responsibilities assigned to the managers.

For example, if a manager is assigned responsibilities to sell products to customers in Rome, the performance measurement of this agent should not include sales to customers in Milan.

The following sections and Table XI describe different types of responsibility centers.

| Table XI | Differences Among Cost, Revenue, Profit, and Investment Centers | ||

|---|---|---|

| Type of Responsibility Center | Responsibilities | Performance Measurement |

| Cost center * | Choose output for a given cost of inputs | Output (maximize given quality constraints) |

| Profit center | Choose inputs and outputs with a fixed level of investment | Profit (maximize) |

| Investment center | Choose inputs, outputs, and level of investment | Return on investment, residual income (maximize) |

| * If output is revenue, this type of center is often referred to as revenue center. | ||

1. Cost Centers

The responsibilities of a manager dictate the type of responsibility center, and imply the appropriate performance measure for the manager.

Some managers have more responsibilities than do others. Those with more responsibilities generally make more complex decisions. Managers with fewer responsibilities have less control over factors that affect organizational value.

The responsibilities of a manager are commonly described in terms of the different types of responsibility centers.

Managers of cost centers tend to have the least responsibilities within an organization. Cost center managers generally have control over a limited amount of assets, but usually have no right to price those assets for sale or to acquire more assets.

A manager of an internal service of an organization is typically a manager of a cost center. Managers of information technology, accounting, personnel, and research and development (R&D) are usually cost center managers. Also, manufacturing managers are normally classified as managers of cost centers.

Cost centers are typically given a fixed amount of resources (a budgetOpens in new window). The cost center is told to produce as much output as it can for the given amount of fixed resources. For example, suppose the manager of a marketing department has a fixed budget for sales staff and advertising.

This manager is evaluated based on the amount of sales generated with the fixed budget. The cost center manager usually has authority to change the mix of inputs, as long as the unit stays within the budget constraint. The marketing manager can substitute between sales staff and advertising, as long as the total cost stays within the budget.

The performance measure for the manager of a cost center is the amount and quality of the output. Producing a large number of units, without controlling for quality, is not in the organization’s best interest; thus, quality must be monitored.

The danger also exists that an output performance measure will motivate the manager to over-produce. Over-production can lead to the imposition of costs on other parts of the organization. For example, the manufacturing manager of a refrigerator plant, who makes more refrigerators than can be sold, will impose costs on the part of the organization that is responsible for storing the finished inventory.

Cost center managers do not have the responsibility to set the price or scale of operations. The cost center manager has the responsibility to change how inputs are combined to produce the output.

Performance measures include:

- total costs,

- quantity produced, and

- quality of output.

2. Profit Centers

Some managers have responsibilities beyond the control of costs through the efficient use of resources. Typically, managers of products are ultimately responsible for both the cost and the pricing of the product.

These product managers are described as managers of profit centers. They have some control over both revenues and expenses, which are the factors that lead to profit. In addition, managers of restaurants and retail shops are typically treated as profit center managers.

Profit center managers are given a fixed amount of assets (for example, the restaurant or retail shop and its furnishings) and usually have the responsibility for pricing and input mix decisions. They can decide what products to produce, the quality level (given some constraints), and how to market the products. For example, the local branch of a chain of restaurants is treated as a profit center.

The branch manager does not have the authority to increase the size of the restaurant premises, nor to open other local branches. The branch manager, however, can change the mix of food and services that are offered in the restaurant, and is also responsible for marketing them.

For example, the manager might decide to provide online reservations, order submission, and catering, and choose to market these services via social mediaOpens in new window and the Internet.

Local branch managers have the responsibility to price the various services offered because they have the knowledge of the local competition. If pricing decisions were not assigned to them, the company could not respond quickly to changes in competitor prices.

One of the goals of a profit organization is to generate profit. Therefore, the primary performance measure for a profit center is the profit that it generates.

Using profit as a performance measure generally will motivate the profit center manager to act in the best interest of the entire organization. However, profit centers are not always independent of other profit centers within the same organization.

For example, managers of hotels belonging to the same chain can affect each other’s profit. Customers who have a bad experience in one of the chain’s hotels are less likely to try its hotels in other locations. Therefore, the evaluation of profit center managers commonly includes other performance measures, such as quality and customer satisfaction, in addition to profits.

Profit center managers have greater responsibilities than do cost center managers.

In many cases, several cost centers are grouped together to form a profit center. The managers of the cost centers within the profit center are managed by, and report to, the profit center manager. For example, a manufacturing unit and a sales unit could be separate cost centers within a single profit center.

- The profit center manager tells the manufacturing manager what to produce, and the sales manager how much cash is available to promote and generate sales.

- The manufacturing and sales managers can choose the mix of resources to accomplish their tasks, but pricing responsibilities are held by the profit center manager.

- The manufacturing manager is evaluated on costs necessary to produce the required output.

- The sales manager is evaluated on sales generated from advertising and the efforts of the sales staff.

- The profit manager is evaluated on the profit of the combined efforts of manufacturing and sales.

3. Investment Centers

Some managers have even more responsibilities than do profit center managers. Managers of profit centers are limited to the use of a pre-specified amount of assets.

- Managers of investment centers have all the responsibilities of a profit center manager, plus the right to expand or contract the size of operations.

- Division managers who control multiple product lines are normally considered investment center managers.

Investment center managers can request more funds from the central administration to increase capacity, develop new products, and expand into new geographical areas. If these requests are too large or inconsistent with organizational policy, they must be ratified by someone in the central administration. Even investment center managers have limits on their authority and some control is imposed.

Investment centers usually contain several profit centers. For example, local branches of a retail chain are treated as profit centers, and regional districts are treated as investment centers.

Managers of the regional district are responsible for all of the locations (profit centers) within the district. In addition, the manager of the regional district has the responsibility of identifying and constructing new locations. If existing retail locations are not successful, the manager of the regional district also has the responsibility to close them.

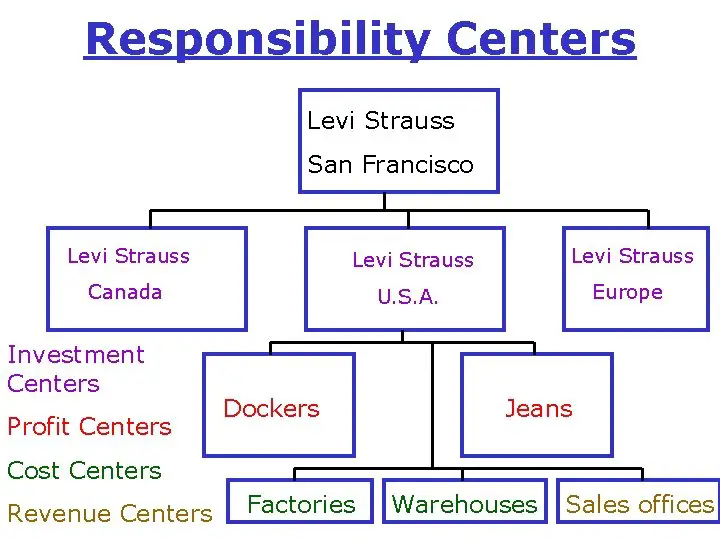

The choice of responsibility centers through the granting of responsibilities reflects the hierarchy of the organization. The organization is composed of investment centers; investment centers are composed of profit centers; and last, profit centers are composed of cost centers. This hierarchy of responsibility centers is illustrated in Figure XI.

Figure I, The Hierarchy of Responsibility | Source: Slide ToDoc Opens in new window

Figure I, The Hierarchy of Responsibility | Source: Slide ToDoc Opens in new window

|

Performance measures for investment center managers are more difficult to identify, due to the nature of their responsibilities. Although investment managers have the opportunity to expand or contract their investment center, they are not generally responsible for financing the expansions.

Cash infusions necessary for expansion usually come from the central administration, which is responsible for issuing debt and equity. Investment center managers tend to only have control of assets and short-term liabilities, such as wages and accounts payable. The accounting reports of these investment centers have no interest expenses or dividend payments.

The absence of interest expenses in an investment center means that profit is not a very good performance measure for a center’s manager.

Investment center managers can often increase their profits by increasing the amount of assets. However, increasing the size of the investment center, without recognizing the opportunity cost of having more cash invested in assets (the opportunity cost of capital), can be harmful for the entire organization.

The opportunity cost of capital is represented by a percentage return that reflects the forgone opportunity of using the cash.

The forgone opportunity could be placing the money in a bank account and earning interest, or the cost of borrowing more money to fund other investment opportunities.

The opportunity cost of capital in the former case is the interest rate earned in a bank account. The opportunity cost in the latter case is the interest rate paid to borrow money. In finance, the opportunity cost of capital must be estimated.

Numerical Example

- The television division of an electronics firm requests $50 million from the central administration to develop, manufacture, and sell a new flat-screen model.

- Central administration borrows the $50 million at an interest rate of 8 percent to provide the cash to the television division.

- The television division invests the $50 million to generate annual profits of $2 million.

What is the net effect of these transactions on the profit of the electronics firm?

Solution

The interest expense on the $100 million is $4 million annually. Therefore, the investment in the new flat-screen television caused a $2 million loss ($2 million profit - $4 million interest expense) to the electronics firm.

Identifying Responsibility Centers

Although cost, profit, and investment centers are identified by the responsibilities of the managers of those centers, not all managers fit exactly into one of these categories.

For example, manufacturing managers are commonly treated as managers of cost centers; yet, the manufacturing managers typically influence revenues, even though they are not responsible for pricing.

Revenues are influenced by customer satisfaction due to timely delivery and quality. The manufacturing manager influences timely delivery and quality, so is partially responsible for revenues.

Profit center managers seldom control all aspects of revenues and costs. Profit center managers, however, are usually able to make marginal adjustments to the asset size of the responsibility center. Investment center managers, alternatively, seldom have unlimited authority to increase asset size.

Therefore, identifying the appropriate type of responsibility center is often difficult. Nonetheless, the partitioning of the organization into different types of responsibility centers is important for guiding the choice of performance measures. In particular, it is important to match the performance measures chosen to the responsibilities assigned to the responsibility center.

You Might Also Like:

- Research data for this work have been adapted from the manual:

- Managerial Accounting: Tools for Business Decision Making By Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso